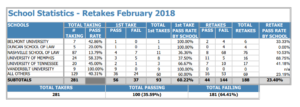

Earlier this morning, the Tennessee Board of Law Examiners released the results of the February 2018 Tennessee Bar Exam. Taken by 281 prospective lawyers, the exam resulted in an unusually low total passage rate of 35%. Although Vanderbilt Law School and the University of Memphis School of Law posted respectable passage rates of 100% and 58%, respectively, the total rate of successful takers was dragged down substantially by another dismal performance by Nashville School of Law, which posted an overall passage rate of just 13%.

One notable bright spot in the exam was the success of Maximiliano Gabriel Gluzman, the “obviously very, very qualified” Vanderbilt Law School graduate who was denied the opportunity even to take the Tennessee Bar Exam until that denial was unanimously reversed by the Tennessee Supreme Court last summer. Thereafter, Mr. Gluzman’s case resulted in substantial amendments to Tennessee’s bar eligibility rules for foreign applicants, which will enable the Volunteer State to play an increasingly large role in conducting international business and prevent continued discrimination against foreign applicants going forward.

Mr. Gluzman’s success, while unsurprising, is also particularly sweet for his lawyer (the author), who has spent much of the past year bristling at the Board of Law Examiners’ assertion—supplied by former Tennessee Supreme Court Justice William Barker—that most people like Mr. Gluzman who take the bar exam “don’t pass.” Like his colleagues on the Board of Law Examiners, former Justice Barker specifically voted against permitting Mr. Gluzman the opportunity even to sit for the bar exam on the basis that: “I just hate for people to come spend all the time and money and years of their lives with no possibility of passing.” Mr. Gluzman has since passed two bar exams, each on his first attempt.

Speaking of people who spend a huge amount of “time and money and years of their lives with no possibility of passing,” however, it is long past time for the Tennessee Board of Law Examiners to take a serious look at what has been going on at Nashville School of Law. For context, in 2014, Nashville School of Law secured new leadership and pledged to improve its state-worst passage rate of what was then 65-70%. Since that time, the school has posted overall passage rates of 50% (February 2015), 28% (July 2015), 30% (February 2016), 28% (July 2016), 35% (February 2017), 38% (July 2017), and 13% (February 2018). In other words: the school is on a downward trajectory, and it hasn’t had a majority of its students pass the bar exam in years. Thus, if the Board of Law Examiners’ concern—expressed passionately with regard to foreign applicants like Mr. Gluzman—that prospective students will spend time and money training for an exam that they have little hope of passing was genuine, then presumably, Nashville School of Law’s consistently anemic passage rate will at some point come under the Board’s microscope.

It should be emphasized that Nashville School of Law has produced many wonderful, capable graduates—including the author’s co-counsel in another major Supreme Court victory earlier this week. Thus, the issue likely has less to do with poor instruction than it does an administration that has liberalized admissions standards and accepted applicants who statistically have no reasonable chance of passing the bar exam after graduating. As the author has previously explained:

Driven by a rapid decrease in law school applicants over the past several years (the total number of law school applicants has declined precipitously since 2010, falling from a high of 87,900 to a low of 54,130 in 2015), the academic credentials of incoming law students have measurably decreased. Controversially, many law schools have responded to this problem (and the corresponding loss of revenue) by decreasing their admissions standards, which has predictably resulted in lower bar passage rates post-graduation.

In other words: to make up for lost revenue, many law schools have simply let in anybody who is willing to pay tuition. The result is a major disservice to countless students who ultimately waste years of their lives and tens of thousands of dollars (or more)—not including opportunity costs—in pursuit of a profession that they likely will never be able to practice.

If Nashville School of Law were accredited by the American Bar Association, it would have been subject to discipline for both its lax admissions standards and its atrocious bar passage rate a long time ago, as Duncan School of Law was earlier this week. However, Nashville School of Law is not an ABA-accredited law school, and it is instead regulated directly by the Tennessee Supreme Court. Hopefully, at some point soon, the Court will step in and force the school to improve its admissions standards in the name of protecting hundreds of future applicants from wasting their time and money on a degree that they will never be able to use.

Like ScotBlog? Join our email list or contact us here, or follow along on Twitter @Scot_Blog and facebook at https://www.facebook.com/scotblog.org